The 1/6 Mortgage Payoff Strategy- Save thousands and Years!

The day you signed your mortgage papers and received the keys to your new home was undoubtedly one of the most thrilling moments of your life. But as the weeks and months pass, the weight of those seemingly never-ending mortgage payments begins to sink in. A 25 to 30-year commitment looms large, and it’s easy […]

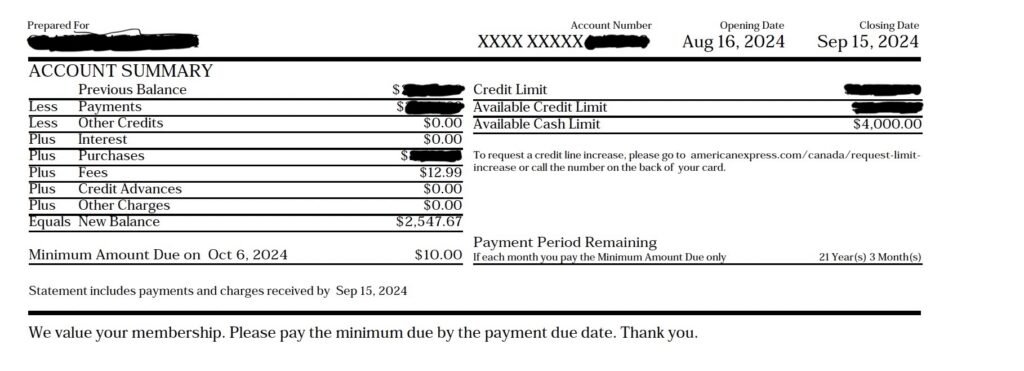

Mastering Your Credit Card Statement: A Guide for Young Adults

So, you’ve just received your first credit card. Exciting times! But now you’re looking at this mysterious piece of paper called a credit card statement, wondering if it’s written in secret code. Don’t worry, we’ve all been there. Let’s break it down and help you become a credit card statement pro! Why Should You Care? […]

10 Simple Ways to Pay Off Loans Faster & Save Big on Interest!

Looking for ways to speed up loan repayment and save on interest? Here are ten (10) simple ways to pay off your loan faster and save big on interest in the long run. Whether it’s student loans, a mortgage, or credit card debt, these small changes can make a big difference in getting you closer […]

Payday Loans: What You Should Really Know Before Borrowing!

Thinking about taking out a payday loan? Before you make that call, it’s important to understand the pros, cons, and costs involved. Let’s break down what you need to know so you can make a smarter decision. Introduction Payday loans might seem like a quick fix when you’re strapped for cash, but they often come […]

Wealthsimple Review: Automated Investing and Fee-Free Banking

Managing your money can be as much fun as a root canal—or at least that’s how it felt to me for years. I constantly switched between apps, logged into different bank accounts, and felt like I was losing control over my finances. I’m sure you’ll relate if you’ve ever felt that sense of overwhelm. But […]

How Mortgage Rate Changes Affect Your Monthly Payments: Examples & Tips

Buying a home is one of life’s most significant investments. But here’s something that often catches people off guard—how mortgage rates changes affect monthly payments. Even the slightest rate shift can mess with your budget. In this article, we’ll show you exactly how mortgage rates influence your payments, with real examples and actionable tips you […]

Can you Day-Trade on WealthSimple?

WealthSimple is a big name in online investing, handling over $30 billion for more than 3 million clients in Canada1. But, many wonder if it’s right for day trading. We’ll look into what WealthSimple offers and what it lacks for day trading. We’ll also discuss the good and bad sides of using it for short-term […]