So, you’ve just received your first credit card. Exciting times! But now you’re looking at this mysterious piece of paper called a credit card statement, wondering if it’s written in secret code. Don’t worry, we’ve all been there. Let’s break it down and help you become a credit card statement pro!

Why Should You Care?

Reading financial documents or statements is probably not your idea of a good time. But here’s the deal: knowing how to read your credit card statement is like having a secret weapon in the adult world. It can help you:

- Catch any suspicious charges (because dealing with identity theft is a nightmare).

- Dodge those annoying late fees (more cash for things you actually enjoy!).

- Keep your credit score in good shape (your future self will be so grateful).

Would you be ready to dive in? Let’s break it down!

The Credit Card Account Summary: Your Financial Snapshot

Please take a look at this section as the highlight reel of your credit card activity for the period under consideration. Here’s what you’ll find:

- Account number: The initial numbers are usually not visible, only the last four digits. It’s like your credit card’s nickname.

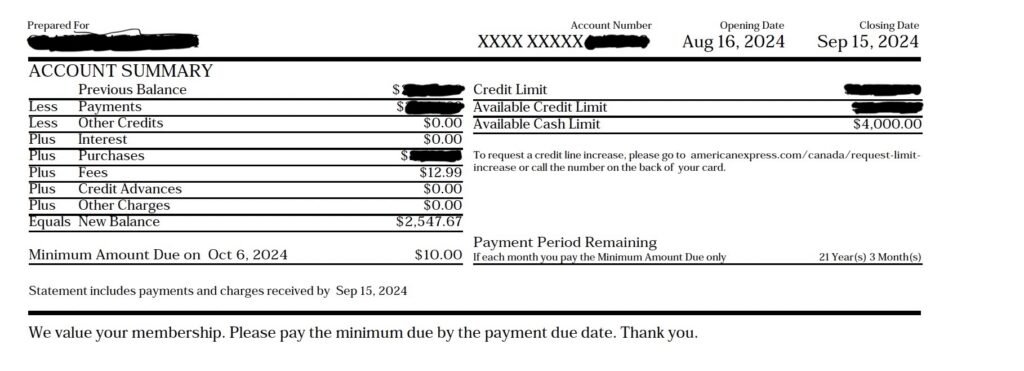

- Statement period: The dates this statement covers. It’s usually a month, but not always from the 1st to the 30th/31st. For example, it can be from Aug 16, 2024, to Sep 15, 2024.

- Credit Limit: This is the maximum amount of credit available on the credit card. It is usually determined when you get the card.

- Available Credit Limit: This is the remaining credit amount available to you at the end of the period. It is calculated as the credit limit minus the total amount spent for the current period.

- Payment due date: Mark this on your calendar, set an alarm, tie a string around your finger – whatever it takes to remember!

- Minimum payment due: This is the least amount you can pay without getting into trouble. But here’s a pro tip: take a proactive approach and try to pay more than this if possible. It’s a great way to show responsibility and keep your balance in check. Let me put this in context: for a balance of $2,804 on my last credit card statement, if I had chosen to pay only the minimum amount of $10, it would have taken me 21 years and three months to pay it up! Gosh!

- New Balance: The total amount you owe right now. Don’t panic! We’ll talk about how to manage this.

Unique Insight: Create a “Statement Day” ritual. When your statement arrives, grab your favourite drink, put on some music, and review it thoroughly. Make it a positive experience, not a chore! And remember, the more you review your statement, the more you’ll understand your spending habits and be able to make better financial decisions.

Credit Card Minimum Payment Calculator

Understanding Minimum Payments

Making only minimum payments on your credit card can significantly extend the time it takes to pay off your balance and increase the total amount you pay due to accruing interest. This calculator helps you visualize the long-term impact of minimum payments on your credit card debt.

By paying more than the minimum each month, you can reduce both the time it takes to pay off your balance and the total interest paid. Consider paying as much as you can afford above the minimum to save money in the long run.

Disclaimer: This calculator provides estimates based on the information you enter. Actual results may vary depending on factors such as changes in interest rates, additional charges, or changes in your payment behavior. This tool is for educational purposes only and should not be considered financial advice. Please consult with a financial advisor for personalized guidance.

Credit Card Transactions: Where Did All Your Money Go?

This section is like a time machine, showing you every purchase you made. You’ll see:

- Date of purchase

- Merchant name (where you bought stuff)

- Transaction amount

- New Payments

Pro Tip: Don’t just skim this part! Look at each transaction. It’s an eye-opening way to track your spending habits. You might be surprised how those “little” purchases add up! I do this every month to ask myself if I need that new iPhone 16 Pro.

Unique Insight: Play “Financial Detective” with yourself. Pick the three most expensive purchases and ask: “Was this worth it?” It’s a great way to start thinking critically about your spending.

Credit Card Fees and Interest Charges: The Not-So-Fun Stuff

This section might make you feel like you’re back in math class, but stick with me:

- Annual Percentage Rate (APR): This is the yearly interest rate. The APR will include the interest rate and the fee charges related to the credit card. Do not mistake this for the interest rate. The lower, the better!

- Interest charged this period: This is simply what you’re paying for borrowing money this month. The interest rates varies for purchases, funds advance and balance transfers.

- Fees: Things like annual fees, late payment fees, etc. Avoid these like you avoid your ex at a party! When you add fees in addition to the interest rates, it is no wonder people are buried deep in debt.

Unique Insight: Think of interest as a “laziness tax.” The quicker you pay off your balance, the less interest you pay. Challenge yourself to pay off your balance in full each month or statement period and watch that interest charge shrink to zero!

Credit Limit and Available Credit: Your Spending Playground

- Credit limit: The maximum amount you can charge to your card. It’s set by the card issuer based on factors like your income, credit score, and payment history. You can’t charge more than your limit without facing penalties.

- Available credit: How much of that limit can you still use? It is the difference between your limit and your current balance. As you spend money on your credit card, the available credit is constantly updated to let you know how much you could spend before reaching your credit limit.

Pro Tip: Use less than 30% of your credit limit. It’s good for your credit score and shows you’re a responsible adult (even if you sometimes eat cereal for dinner).

Minimum Payment Warning: The Scary (But Important) Part

This section shows how long it’ll take to pay off your balance if you only pay the minimum. Spoiler alert: It’s usually a very long time and costs a lot of interest. For example, the purchase interest rate on my American Express Cobolt Card is tiered Preferred 20.99%, Standard 25.99% and Basic 28.99%. Funds advance is Preferred 21.99%, Standard 25.99% and Basic 28.99%. Trust me, that is ridiculous! It only applies if you do not pay your balance before the payment due date.

Unique Insight: Calculate your purchases’ “real cost” if you only make minimum payments. That $50 shirt could end up costing you $70 or more! Is it still worth it?

Credit Card Rewards Summary: The Fun Part!

If your card offers rewards, this section shows your points or cashback. It’s like a video game score, but it’s way more useful! Maximizing your rewards can turn your everyday spending into exciting bonuses and benefits.

Pro Tip: Don’t let points expire! Set a reminder to check and use your rewards regularly.

Important Messages: Don’t Skip This!

This section might include changes to your card terms or special offers. It’s usually boring, but ignoring it is like skipping the “terms and conditions” – it might come back to bite you!

Payment Information: How to Keep the Credit Card Gods Happy

This tells you how to pay your bill. If possible, set up automatic payments, but ensure you always have enough in your bank account!

Customer Service Info: Your Lifeline

Save these numbers on your phone. Don’t be shy about calling if you see a weird charge, like a transaction from a place you’ve never been a duplicate charge, or have questions about your statement. It’s their job to help you!

Wrapping It Up

Understanding your credit card statement is like learning to read a new language – the language of adulting! It might seem tricky at first, but you’ve got this. Remember, every financial wizard started somewhere, and you’re already on your way.

Final Unique Insight: Create a “Credit Card Statement Cheat Sheet” for yourself. Write down the key monthly things you want to check (total spent, biggest purchase, rewards earned, etc.). Stick it on your fridge or in your wallet. It’ll help you stay on top of your finances without getting overwhelmed.

Now, go forth and conquer those statements! Your future self (and your bank account) will thank you. 💪💳