Managing your money can be as much fun as a root canal—or at least that’s how it felt to me for years. I constantly switched between apps, logged into different bank accounts, and felt like I was losing control over my finances. I’m sure you’ll relate if you’ve ever felt that sense of overwhelm. But then, I stumbled onto Wealthsimple, and let me tell you, it was like finally finding the missing piece to a puzzle I didn’t even know I was solving.

Suddenly, my financial life wasn’t a mess of scattered accounts and endless fees. It became organized, automated, and exciting. Today, I want to share why Wealthsimple has become my go-to app for everything from saving to investing.

A Cash Account with No Strings Attached

Ever get hit with a $10 monthly maintenance fee, or worse, a $35 overdraft charge because you accidentally bought an extra coffee? Yeah, that used to happen to me, too. But that’s one reason why I love Wealthsimple’s Cash Account—it’s completely fee-free.

A $10.95 monthly account fee adds up to $131.40 a year, simply for keeping my money in the bank!

A $29.95 monthly account fee adds up to $359.40 a year, just for leaving my money in the bank!

Let’s talk about why this matters. According to a 2019 study published by the American Psychological Association, financial stress is one of the top causes of anxiety for adults. When those pesky fees banks sneak in, they only add to that stress. Having an account where I know I won’t be hit with surprise charges is small, but it gives me peace of mind.

- No monthly fees. Keep your money for yourself—no deductions. It offers the extra earnings of a savings account combined with the flexibility of a chequing account, all in one convenient place

- No overdraft penalties. Even if you overspend by accident, you’re not punished for it. You’ll simply stop spending until you add funds.

- Easy transfers. You can send up to $5,000 per day or $10,000 per week using Interac e-Transfer. That’s perfect for sending money to friends, family, or even paying rent without worrying about limits. I once had to send money for a group vacation, and thanks to the high daily limit, I could do it all in one transfer. No juggling between apps or paying multiple transfer fees.

Automation at Its Finest: Set It and Forget It

Let’s be real—most of us don’t have the time or mental energy to stay on top of our finances constantly. There’s work, family, hobbies… life. That’s where Wealthsimple’s automation features have become my secret weapon.

Take a minute to think about your routine. If you’re anything like me, life gets busy. It’s easy to forget to save or invest until it’s too late. Wealthsimple solves this problem with features like auto-deposits and recurring investments.

- Auto-deposits: I set up automatic transfers to my investment account every month. Whether it’s $50 or $500, the money gets invested without me lifting a finger.

- Recurring investments: Want to take advantage of dollar-cost averaging? Wealthsimple lets you set up monthly purchases of stocks or ETFs. This means you’re buying regardless of market highs or lows, which ultimately helps smooth out your investment returns.Behavioral Finance studies show that automation helps us avoid “decision fatigue”—the mental exhaustion that comes from making too many small decisions. By automating, I’m reducing stress and making smarter, more consistent financial decisions without even thinking about it.

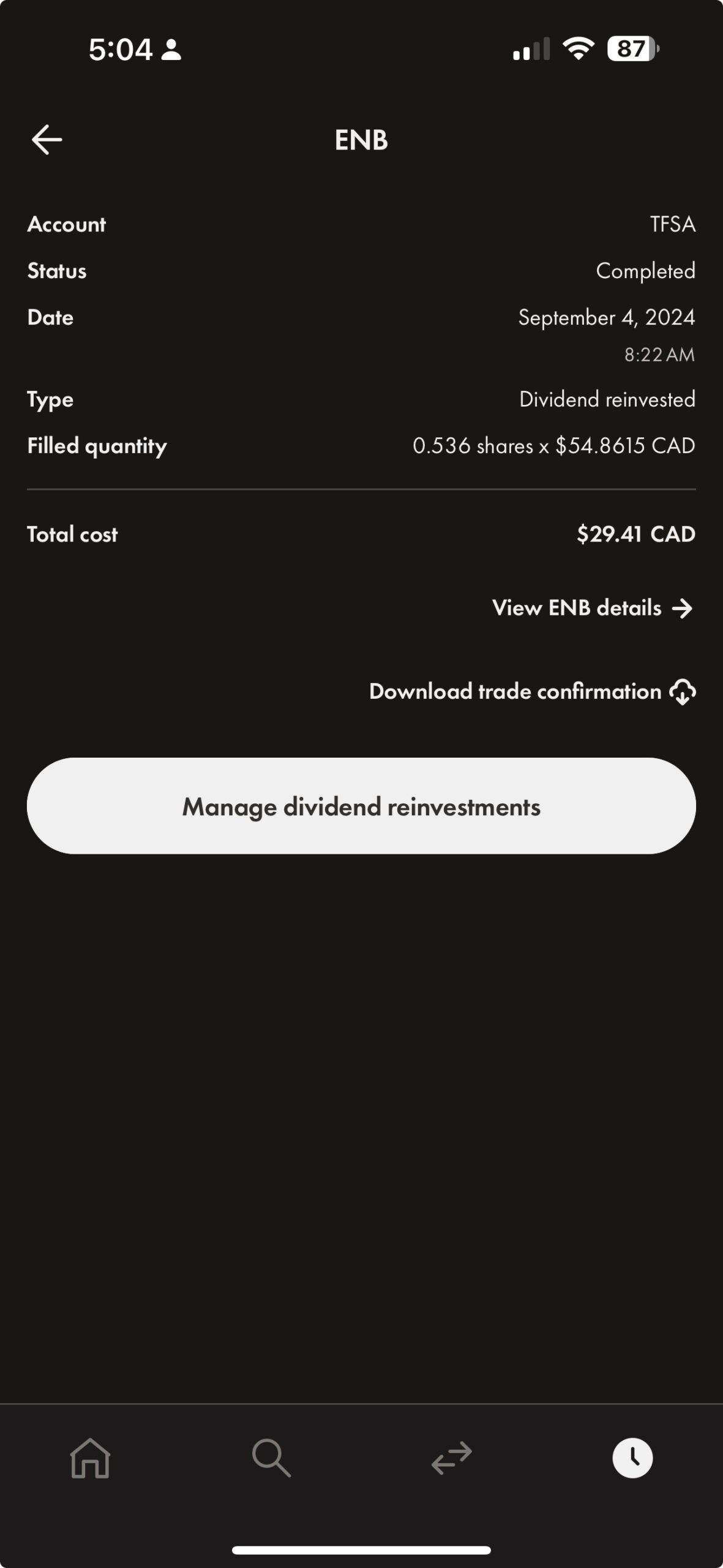

- Dividends? No problem! With the Dividend Reinvestment Plan (DRIP), Wealthsimple automatically reinvests dividends into more shares. So rather than cashing out, you’re building your portfolio—essentially letting your investments compound and grow. I remember the first time I got a dividend payout. Instead of having to manually reinvest it, Wealthsimple automatically did it for me. That moment felt like I had an invisible financial manager working for me.

Multiple Accounts: All in One Place

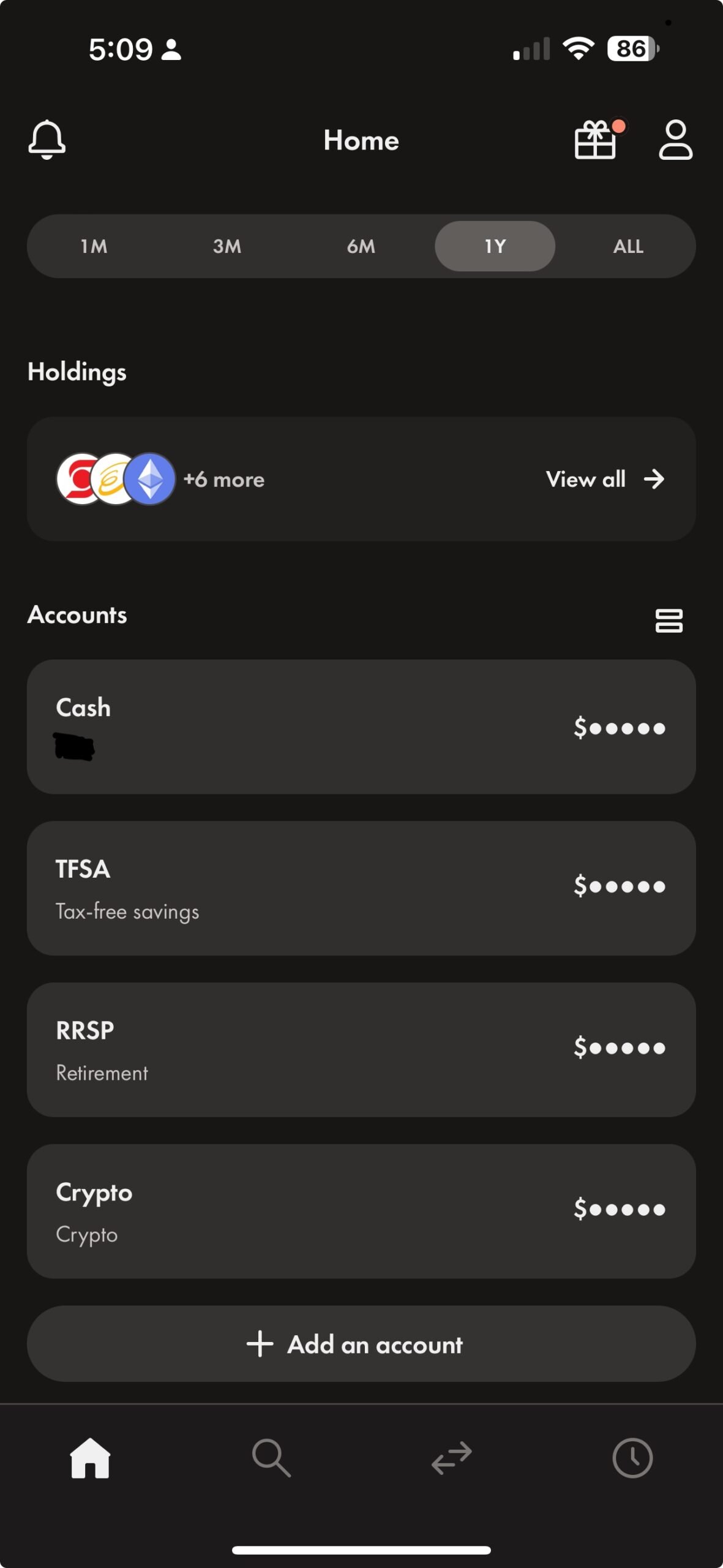

Do you know those moments when you need to check multiple accounts, but you must remember three different passwords and navigate a maze of apps? Yeah, I’ve been there. Wealthsimple solves this with an all-in-one dashboard that shows your Cash Account, TFSA, and RRSP all in one place.

Let me break it down:

- Tax-Free Savings Account (TFSA): It’s perfect for investing without paying taxes on your earnings. It’s like giving your money a tax-free turbo boost.

- Registered Retirement Savings Plan (RRSP): Contribute towards your retirement while benefiting from tax deductions today.

- Cash Account: Your everyday, no-fee account that keeps your spending in check.

By having everything in one place, I can see at a glance how much I’ve saved, how my investments are doing, and whether I’m on track for retirement. It’s streamlined, organized, and honestly, it just makes life easier.

Options and Stock Lending: For the Advanced Investor

When I first started using Wealthsimple, I was mostly focused on simple investing—like buying ETFs and letting them grow. But as I’ve become more comfortable, I’ve dabbled in more advanced features, like options trading and stock lending.

For the uninitiated, options trading lets you buy or sell the right to buy a stock at a certain price. It sounds complicated, but Wealthsimple’s simple interface makes it easy to dip your toes into this more complex investing strategy.

And stock lending? That’s when Wealthsimple lends out the stocks you own (while you retain ownership) to other traders. In exchange, you earn passive income from it. The best part? It’s all automated.

Both features allow me to maximize my portfolio without spending all day researching or making complicated decisions.

Even with all these features, the best part of Wealthsimple is its simplicity. Everything from setting up auto-deposits to trading options is laid out clearly. You don’t need to be a financial expert to navigate the app. Wealthsimple is designed to make investing accessible to everyone.

But what good is a financial app if you don’t trust it with your money? Wealthsimple employs bank-level encryption and is overseen by Canadian financial regulators. That gives me peace of mind knowing my hard-earned cash is protected.

According to research by the Pew Research Center, trust is a key component in choosing financial platforms, and Wealthsimple nails it in this department. It’s nice knowing I can leave my money in good hands while focusing on other things in life.

Conclusion

At the end of the day, Wealthsimple has given me something more valuable than just a financial platform—it’s given me peace of mind. From its fee-free Cash Account to its automation features like auto-investing and DRIP, Wealthsimple simplifies everything. I don’t have to constantly monitor my finances because I know they’re being taken care of behind the scenes.

Like any other investment and banking solutions, WealthSimple has its drawbacks, which may vary based on your specific needs. Be sure to do your due diligence and thorough research before deciding if it’s the right choice for you.

So, if you’re like me and want a one-stop solution for managing your finances without the headaches, I highly recommend giving Wealthsimple a try. You’ll wonder how you ever managed without it.

Ready to simplify your financial life? Try out Wealthsimple today and experience the ease of automating your savings and investments. Sign up in just a few clicks.